Just had an all-too-brief appearance on Protect Your Assets, a weekly show with David Hollander on KGO. I was honored to be asked back, and it’s fun to participate. But this time the time really flew by, and I felt so many important points were left unsaid.

So here’s the quick summary of the basic question: what has happened in our East Bay Area real estate market in the past year.

A year ago all the talk was about buyers sitting on the fence. Buyer apathy and lack of willingness to make a decision changed quickly to motivation. The change occurred quickly at the beginning of 2012 in SF, two months later in the East Bay, mid-March, specifically. Rates had been great last year. Yes, they’re even better now, but that wasn’t the big difference. Issues of confidence were huge: buyers needed to see that the bottom had been reached before they were truly motivated—concerns over jobs were a major factor. Now the increase in tech jobs has trickled up from Silicon Valley, to SF, and across the Bay, increasing confidence

—there’s an emotional component—many buyers simply got tired of waiting

—enormous increase in rental rates first in SF and then in the East Bay have motivated buyers to jump into the market. Oakland rents are up over 19% from last year! I’ll write a separate post focusing on that! But just so you know, average rental rates in SF are now between $2700-3000 for 600-900 sq. ft.  I’ll show you what that can buy for that amount in the East Bay!

We said all last year that we had low inventory, and historically we did.

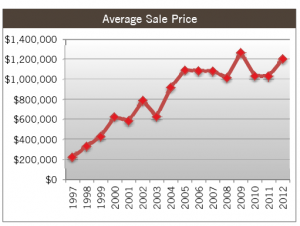

This year inventory is down 54% from the low levels of last year.Now we have twice to three times as many buyers competing, for half of the inventory. Basic supply and demand have resulted in what is mostly a sellers’ market. It’s always easier for buyers to get ready than sellers, many of whom need to make repairs or upgrades, let alone pack up. And the real problem comes if they’re staying in the same market, and they need to compete for their replacement home—many would-be sellers have delayed for that reason, and it’s understandable. Some sellers are still waiting, hoping that their homes will again hit the peaks prices we saw in the second quarter of 2007.

A quick look at the numbers:

Q3 2012 vs. Q3 a year ago for single family homes in a six city area: Albany, Berkeley, El Cerrito, Kensington, Oakland and and Piedmont (by the way, I work in Alameda as well, but that’s a rather separate market.)

$$ volume of single family home sales is up 19%

Average price is up by 16%–the highest average prices since 2008.

Months supply of inventory is down from 2.3 last year (really low) to 1.1 mos this year.

55% of homes are selling over asking price (100% of homes I’ve been involved in!)

Hottest price point is $700-800K range, where 77% sold over asking

In the entire range of $600K-900K, 0.6-0.8 months of inventory exist. Low inventory is resulting in higher prices:

Berkeley is up 6% year-to-year

Berkeley Hills up 10%

Oakland is up 22%

El Cerrito up 11 %

But still there is good news for buyers:

—On average, peak in our area was Q2 of 2007; current Q3 avg. prices are off by 33%. On average we’re at 2002 levels.

—New listings that came on in the 5 weeks since Labor Day is up 14% over last year. Within the past two weeks it has felt like a new wave of attractive offerings.

So buyers: have faith, and get as prepared as possible. I’m always happy to talk about the best strategies for each buyer’s situation.

And sellers, it’s NOT too late to put your home on the market still in 2012. There are tax advantages, and there is remarkable demand from buyers. Unlike in areas of extreme weather, buyers will be out in force. Remember all of those gorgeous Christmas days?? And if you can’t get ready for 2012, it’s time to be preparing to be one of the earlier homes on for 2013.